Divided Political Landscape

The political climate ahead of the upcoming election is fraught with challenges for both major parties, especially as President Trump's ambitious tax agenda garners unexpected attention among Democrats. Though the Democratic party has largely condemned Trump’s expansive policy bill for its potentially devastating societal impacts—like cutting health coverage and food assistance—a different story emerges when it comes to the tax provisions intertwined within this contentious legislation.

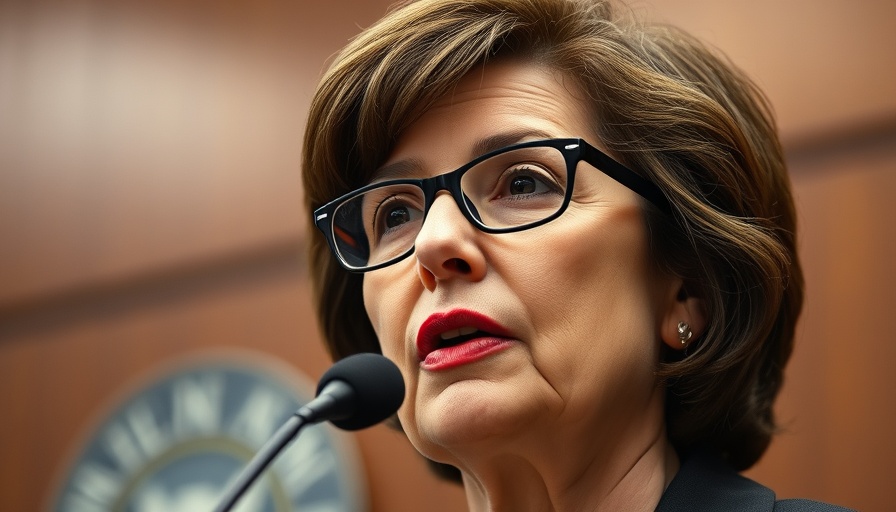

A Surprising Support

Democrats, often vocal critics of Trump's methods, have recently hinted at a willingness to support specific elements of his tax proposals, especially those perceived as beneficial to everyday citizens. This nuanced stance was highlighted when Senator Jacky Rosen from Nevada successfully led an initiative to push through what has been dubbed the "no tax on tips" proposal. While it's essential to recognize that this move is largely symbolic—given House rules require tax bills to originate there—it does signify a shift in how some Democrats are approaching Trump’s policy agenda. “I am not afraid to embrace a good idea, wherever it comes from,” Rosen remarked to the Senate, emphasizing that certain tax provisions could be beneficial if separated from the overall package.

Why This Matters for Local Communities

For many residents, these tax proposals have practical implications. The potential elimination of taxes on tips could directly benefit workers in sectors like hospitality and food service, providing them with more disposable income. As public services and local business dynamics continue to evolve, such tax initiatives could serve as a lifeline for small establishments trying to navigate the post-pandemic economic landscape. The community-level ramifications of these Democratic endorsements could resonate more broadly as they interact with issues such as community safety, local jobs, and school funding.

Realizing Potential Tax Cuts

It’s clear that some of Trump’s tax promises resonate with constituents. As certain provisions are re-evaluated for their broad appeal, they underscore an essential dilemma: While the larger bill incorporates cuts that critics argue will harm vulnerable populations, it also includes popular tax cuts that many supporters advocate for. This dual nature offers an opportunity for the communities to understand not just the implications of federal policy but also how local government and city councils react to these shifts in legislation. Moreover, instilling a tax cut framework that is palatable to both parties could present a rare moment of cooperation.

Addressing Misconceptions

Despite the support for particular tax cuts, some misconceptions exist within the public discourse. Many citizens perceive all components of Trump's tax agenda as detrimental; however, understanding the complexity—for instance, how some tax cuts might effectively stimulate local economies—becomes crucial. Engaging in transparent conversations about these policies can empower community members and help dispel myths surrounding tax reforms.

Future Predictions: The Path Ahead

As Trump’s policy bill progresses through Congress, the combination of popular tax cuts may influence the legislative landscape not just today, but also in future elections. It presents an opportunity to examine how diverse political strategies could shape community interests down the road. Local and state politicians will need to calculate their responses carefully as they balance their constituents' needs with party lines, potentially leading to an unexpected reevaluation of alliances.

Call to Action: Stay Informed

With the future of local public services hanging in the balance, it's critical for community members to stay informed about these developments. Engage with local government updates, attend city council meetings, and participate in discussions about local resilience. Understanding the complexities of these tax proposals will empower you to advocate for what truly benefits your community.

Add Row

Add Row  Add

Add

Write A Comment